The Big New, Low-Income Solar Tax Credit

Photo Credit: Quest Solar

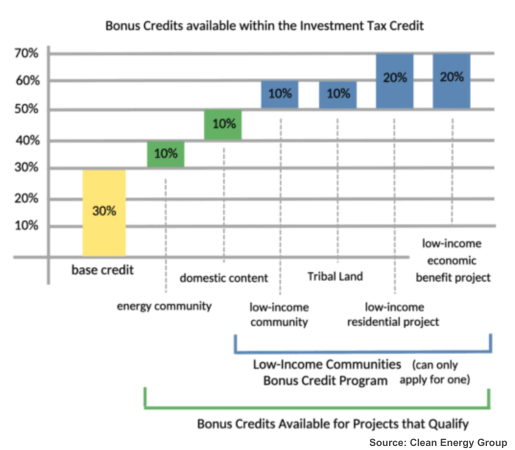

As we begin the new year, we want to share with you a major new opportunity. Capacity remains for certain affordable housing providers, and property owners in designated low-income areas, to realize a 10% to 20% *bonus* Federal income tax credit – in addition to the base 30% tax credit value. If you’re interested in learning more, including how non-profits may benefit, read on!

The Low-Income Communities Bonus Credit Program, debuting on Oct 19, 2023, is an important provision of the Inflation Reduction Act. This program offers a 10% to 20% increase to the solar Investment Tax Credit (ITC) – above the base 30% tax credit value - for eligible projects, totaling 1.8 GW per year. The Department of Energy heralds this program, open to 1.8 gigawatts of solar annually, as “the most significant tax incentive in U.S. history” to drive cost-saving clean energy initiatives in low-income communities, fostering economic growth in historically underserved areas.

Who Can Still Apply

For this program, the DOE has multiple categories of low-income projects. The program capacity dashboard shows there’s substantial remaining capacity for projects meeting the below selection criteria, in addition to projects in Indian land. While most other categories are over-subscribed, two categories still accepting applicants are:

Category 1 – 10% tax credit bonus: Solar projects Located in Low Income Communities, meeting certain additional selection criteria

Category 3 – 20% tax credit bonus: Qualified (Federally regulated) Low-Income Residential Building Projects, meeting certain selection criteria

Act Now to Secure Your Spot

As of January 22, 2024, only 44% of the available capacity has been filed. There is still 162 MW of capacity that remains available and is waiting for your application. If your property falls within one of the above categories, now is the time to submit. There are several eligibility requirements for existing capacity, including projects in very low-income areas and non-profit ownership of projects. Applications are currently being accepted on a rolling basis. Nonprofits are eligible for a direct payment, where the IRS writes a check for the value of the tax credit.

Crauderueff Solar is Helping Organizations Access this New Bonus

These below case studies show how Crauderueff & Associates has helped both faith based organizations and low income housing providers take advantage of this recent incentive boost.

In 2019, Catholic Charities Progress of Peoples Development Corporation (CCPOPD) launched the Laudato Si Corporation, a non-profit special purpose entity dedicated to advancing environmental sustainability and climate resiliency by generating renewable sources of energy and revenue. In our capacity as Owner’s Representative, we helped Laudato Si apply for the 20% tax credit bonus for 12 of its buildings which all participate in a federal housing program. Moreover, as a 501(c)(3) organization, Laudato Si was able to apply through the additional selection criteria category which makes it highly likely to receive this bonus for its portfolio.

The University Neighborhood Housing Program applied for the 10% tax credit bonus for its multifamily portfolio composed of 7 properties, all located in a low-income community. Similar to Laudato Si, UNHP as a non-profit organization applied through the additional selection criteria category and will likely receive this tax credit bonus.